The Procter & Gamble Company (P&G) is an American consumer goods giant specializing in a wide range of personal care and hygiene products. The company manufactures well-known household products, including Crest, Charmin, Tide, Oral-B, Bounty, Febreze, Downy, and Gain. Today, P&G is one of the world’s largest consumer goods company with net sales of $80.1 B and net earnings of $14.7 B during its fiscal year 2022. Procter & Gamble products are sold in more than 180 countries with a workforce of over 100,000 employees.

- P&G was incorporated in Ohio in 1905, having first been established as a New Jersey corporation in 1890, and was built from a business founded in Cincinnati in 1837 by William Procter and James Gamble

- According to P&G, its strategy fuelling growth is based on a versatile and strong products portfolio followed by the pursuit of excellence, focus on enhancing efficiency, continuous innovation, and empowerment of the employees

- P&G products are sold to retailers or direct-to-consumers. Sales to Walmart and its affiliates represent approximately 15% of P&G's total sales in 2021

- To offset rising expenses, the corporation has been boosting product pricing, but this policy has put pressure on customer demand, resulting in volume declines for the past two fiscal quarters

BILLION DOLLAR BRANDS

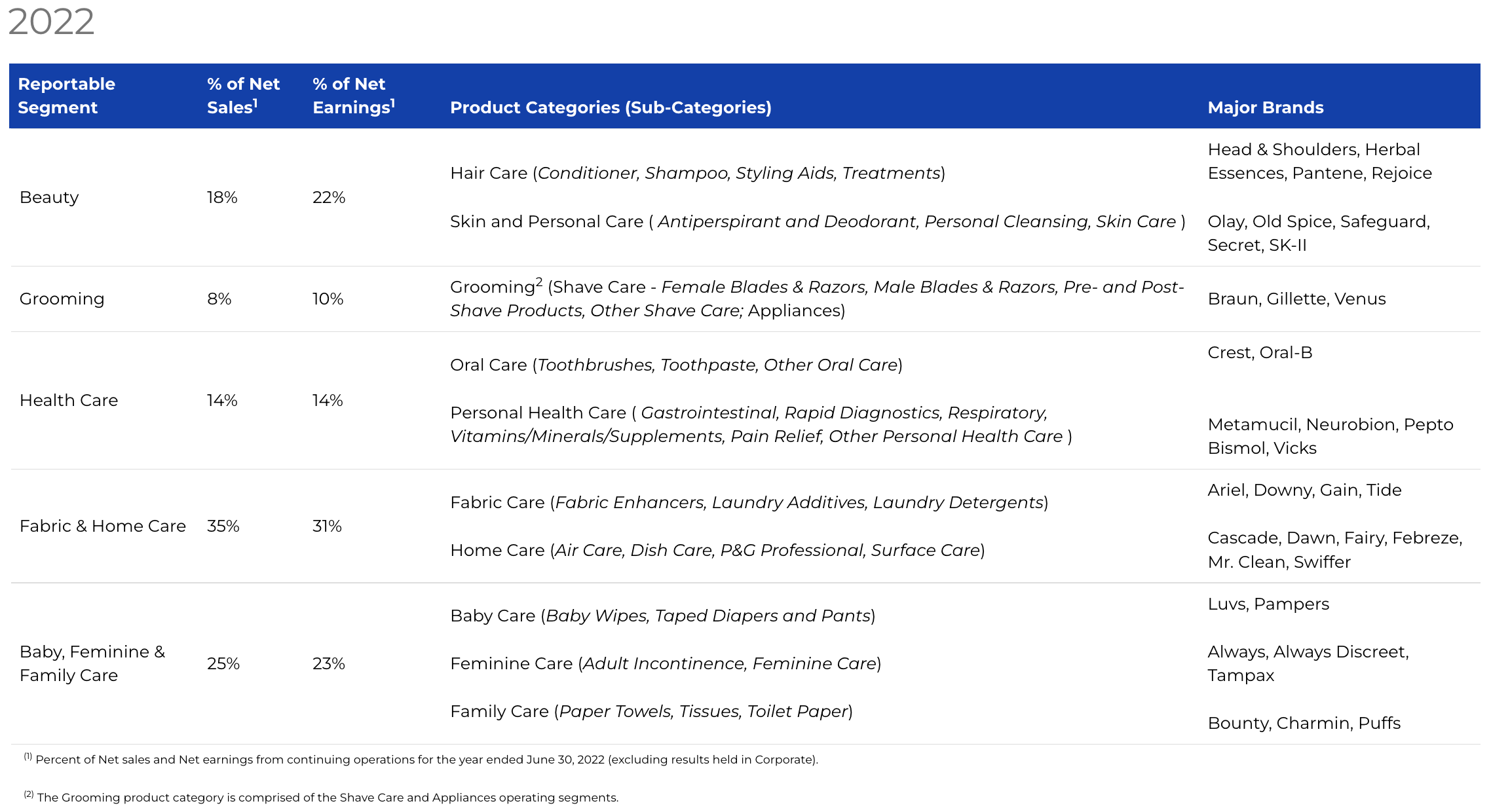

P&G's product portfolio consists of 65 individual brands organized into 10 product categories of daily-use products, including personal healthcare, oral care, fabric care, home care, skin, and personal care, haircare, grooming, baby care, feminine care, and family care. In each of these categories, P&G has a market-leading share, and the company strives to leverage its position to scale up.

P&G's 10 product categories are organized into 5 reportable segments: (i) Beauty (Hair Care and, Skin and Personal Care), (ii) Grooming (Shave Care and Appliances), (iii) Health Care (Oral Care and Personal Health care), (iv) Fabric & Home Care and (v) Baby, Feminine & Family Care.

- (i) Beauty: Includes hair care and skin and personal care. P&G is the market leader in the retail hair care market with over 20% global market share with its Pantene and Head & Shoulders brands. In skin and personal care, the Olay brand is one of the top facial skin care brands in the world with approximately 6% global market share

- (ii) Grooming: Includes shave care and appliances. In shave care, P&G is the global market leader in the blades and razors market with a 60% market share, its most popular brands are Gillette and Venus. In appliances, P&G holds over 25% of the male electric shavers market and over 50% of the female epilators market, primarily under the Braun brand

- (iii) Health Care: Includes Oral Care and Personal Health care. In Oral Care, P&G has a number two market share position with nearly 20% global market share behind its Crest and Oral-B brands. In personal health care, P&G sells respiratory treatments (Vicks brand) and digestive wellness products (Metamucil and Pepto Bismol brands). In 2019, P&G acquired Merck OTC

- (iv) Fabric & Home Care: In fabric care, P&G has over 25% global market share, primarily behind its Tide, Ariel and Downy brands. In global home care, market share is nearly 25% across the categories in which the company competes, primarily behind its Cascade, Dawn, Febreze and Swiffer brands

- (v) Baby, Feminine & Family Care: P&G is the global market leader and competes mainly in taped diapers, pants and baby wipes with over 20% global market share. Pampers is the company's largest brand, with annual net sales of over $7 billion

A BIG ADVERTISING SPENDER

Procter & Gamble ranks among the top companies globally in terms of advertising expenditures. In fiscal 2022, Procter & Gamble spent about $7.9 B on advertising. The company invested $117 m on the promotion of its Crest brand in the U.S. alone in 2019.

Inflation has made advertising spending even more important for P&G as it tries to prevent consumers from moving to less expensive brands and convince them to keep paying up.

- P&G has spent money on marketing and product development to persuade customers that buying more expensive versions of its products will ultimately save them money

- However, according to Nielsen data, P&G has recently underperformed rivals both generally and in important categories like razors, laundry detergent, and paper towels

“There are certain brands that have so much loyalty, but at some point people have to make sacrifices, [...] Tide is sitting there at $11.99 and another brand is $3 less. It’s starting to not even be a decision for people anymore.” said Arthur Ackles, VP of merchandising and buying for the Roche Bros. grocery chain in the Boston-area of the U.S.

THE MARKET

P&G's operates in the highly competitive FMCG (Fast Moving Consumer Goods) market with global, regional and local competitors. In many of the markets and industry segments in which P&G sells its products, the company competes against other branded products, as well as retailers' private-label brands.

The Global FMCG Market is anticipated to expand by $ 310.5 B between 2022 and 2026, with a CAGR of 2.3%. The global market size is estimated at over $15,000 B by 2025 according to Allied Market Research.

- The industry is propelled by an increase in disposable income, a change in lifestyle, and rising demand for pharmaceutical items

- E-commerce online distribution is also becoming more popular

P&G has also been pushing to scale its e-commerce capabilities. During fiscal year 2022, P&G increased e-commerce sales by 11% and now represent 14% of total sales.

RECESSION PROOF?

Grocery prices rose 13% from a year ago, contributing to a record four-decade high in consumer inflation in the U.S., excluding energy and food. Executives claim that while the company makes investments in its premium brands, it is also ready in case customers decide they require less expensive alternatives.

- P&G claims that compared to more than ten years ago during the previous economic downturn, it now offers a greater choice of packaging sizes and more brand products in lower price ranges

This may not be enough, though, as global price increases driven primarily by food are putting pressure on consumer budgets; the energy crisis brought on by the conflict in Ukraine has had a particular impact on Europe. Inflation in the Eurozone reached 10% in the year ending in September, while it is also double digits in the UK.

- The rise in inflation has so far been better for manufacturers of global brands such as P&G than anticipated, but the squeeze has started to drive more consumers toward own-brands and less expensive goods

- “We see high pressure on the European consumer, with high inflation and, certainly . . . energy costs will hit the consumer over the winter period.” Andre Schulten, P&G's CFO

However, P&G is a consistent dividend payer. In April 2022, the company raised its dividend by 5% marking the 66th consecutive annual dividend increase, and the 132nd consecutive year in which P&G has paid a dividend. The company should continue to do so in any environment, be it a recession or an expansion.

MANAGEMENT

Procter & Gamble is currently led by Jon Moeller who is P&G’s Chairman of the Board, President and Chief Executive Officer since November 2021.

- Jon Moeller is P&G’s Chairman of the Board, President and Chief Executive Officer since November 2021

- Prior to becoming CEO, Moeller was P&G’s Chief Operating Officer for more than 12 years. Since joining P&G in 1988 as a cost analyst, he has held various senior leadership roles in categories, sectors and regions, including assignments in China, as the company’s Treasurer, Global Beauty, Health, Feminine Care Finance Senior VP, and Corporate Forecasting & Analysis

- Holds a B.S. in Biology and an M.B.A. from Cornell University

- Jejurikar is P&G's Chief Operating Officer since November 2021

- As Chief Operating Officer (COO), Shailesh leads Information Technology, Global Business Services, Sales, Market Operations, Purchasing, Manufacturing, Distribution and New Business for the company. Previously, Shailesh was the Chief Executive Officer of Procter & Gamble’s largest business sector, Fabric & Home Care, which includes many of P&G’s most-iconic brands: Tide, Ariel, Downy, Gain, Febreze, Swiffer—and represents about one-third of total company sales and net earnings

- Holds a B.A. in Economics from Mumbai University and an M.B.A. from the Indian Institute of Management-Lucknow

- Schulten is P&G's Chief Financial Officer since March 2021

- He oversees all financial actions of the Company and leads the Finance & Accounting organization. As part of P&G’s Global Leadership Council, he is also a key strategic leader as the company continues delivering sustained growth for P&G’s shareholders. He has been part of P&G for over 25 years

- Hold a Diplom Kaufman, Business and Operations Research from the University of Münster

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Procter & Gamble is an American consumer goods giant specializing in a wide range of personal care and hygiene products with annual net sales of $80.1 B in FY2022

- P&G product’s portfolio consists of 65 individual brands organized into 10 product categories, in each of these categories, P&G has a market-leading share

- With inflation hitting consumers, P&G is spending big on advertising as it tries to prevent consumers from moving to less expensive brands and convince them to keep paying up

- The FMCG market is highly competitive and P&G battles against other branded products as well as retailers' private-label brands

- P&G is pushing to scale its e-commerce capabilities as more and more consumers move to buy consumer goods online, e-commerce sales account for 14% of total sales

- P&G is a consistent dividend payer, a recession and inflation should not materially impact P&G's ability to continue pay and increase its dividend

- P&G is currently led by Jon Moeller who is P&G’s Chairman of the Board, President and Chief Executive Officer since November 2021

FINANCIAL CHECK

The Procter & Gamble reported first quarter fiscal year 2023 net sales of $20.6 B, an increase of 1% vs the prior year. Excluding the impacts of foreign exchange, acquisitions and divestitures, organic sales increased 7%.

- Diluted net EPS were $1.57, a decrease of 2% vs prior year EPS

- Operating cash flow was $4.1 B for the quarter vs $3.7 B during the prior quarter

- P&G returned nearly $6.3 B of cash to shareholders via approximately $2.3 B of dividend payments and $4 B of common stock repurchases

- P&G raised prices by 9% year-on-year across its product lines in the first quarter of fiscal year 2023

The strong dollar is also hurting P&G, which receives more than half of its income from outside the U.S.. The company projects that the strong dollar would cost them $1.3 B this fiscal year, or 6% less in sales growth than first projected.

- “We fully expect more volatility in costs, currencies and consumer dynamics as we move through the fiscal year.” Andre Schulten, P&G's CFO

In contrast to its earlier prediction of flat to 2% growth, P&G now anticipates its sales volumes to decline by 1% to 3% throughout its fiscal year.

THE BOTTOM LINE

The Good

- P&G has proven its ability to pass on higher costs to consumers even as inflationary pressures mount

- The company is a consistent dividend payer, a recession and an inflationary environment should not impact P&G's dividend

The Bad

- The capacity of P&G to charge premium rates depends on a variety of external factors, including the rate of inflation, how consumers will respond to cost increases, and the state of the economy as a whole

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Procter & Gamble