This Is Not 2018 And The Fed Won't Bail You Out

The Fed signalled continued monetary tightening in late 2015 and again in late 2018, but then backed off in the subsequent months as financial markets soured. This created the perception that the central bank was poised to bail out investors when markets were falling a bit too sharply.

- However, throughout these occurrences, longer-term bond yields dropped

- Financial markets were effectively indicating that the Fed was making a mistake, putting the country at risk of a recession that would force policymakers to reverse course and keep rates lower for longer

This Is 2022

But inflation is here and might be here to stay longer than expected. Also, bond rates have been climbing and the yield curve has been steepening this time. This therefor suggests that investors believe the Fed will have to further raise rates in order to fight off inflation.

- Yet, only the frothiest portions of the economy, such as underperforming tech companies and crypto assets, have seen the greatest losses

- While cuts on more mature companies have for now just rationalised valuations

The Fund Blunders Again, Part 2

During the pandemic, the Fed went out of its way to save the economy. Some might argue that it exceeded its mandate by seeking to keep the whole economy running while even seeking relatively more social or political goals such as engineering a "broad and inclusive" recovery.

"The Federal Reserve is committed to providing sustained accommodation to achieve a broad-based recovery. Further targeted fiscal support will be needed alongside accommodative monetary policy to turn this K-shaped recovery into a broad-based and inclusive recovery."

"Minority small businesses have been particularly hard hit. According to recent research, between February and April, the economy saw a 41 percent decline in Black business owners and a 32 percent decline in Latinx business owners, compared with a 22 percent overall decline." October 21, 2020, Achieving a Broad-Based and Inclusive Recovery, by Governor Lael Brainard

This backfired in a grand manner as inflation is now eating away the savings of minorities and less privileged tranches of society. Back in January, we wrote:

- After being too dovish for months, we believe the Fed is racing towards a second mistake by being too hawkish and may put the recovery at risk by increasing rates while it most probably will fail to contain inflation

- We believe the Fed should be more cautious in its approach and focus on providing a stable environment businesses can trust rather than rushing to solve all of a nation's problems on its own

- Yet, we believe the Fed won't back down and push ahead with its hawkish rhetoric. We thus expect growth stocks to endure a weak environment going forward while highly profitable businesses trading at a reasonable valuation may fare better

We therefor believe the Fed is blundering again. First, it took away the savings of the minorities it sought to protect. And at the current pace of rate rises, it also engineering another recession.

Forcing A Recession

During the pandemic, the Fed did all it could to save the economy but also the nation as a whole. It backfired as the excess liquidity spurred investors and consumers to spend and take excessive risks in a world where money is cheap.

“We have people who know nothing about stocks being advised by stock brokers who know even less, [...] It’s an incredible, crazy situation. I don’t think any wise country would want this outcome. Why would you want your country’s stock to trade on a casino?” Charlie Munger

But what happens when money is cheap? Well, money also starts buying you less as inflation kicks in. Are the hands of the Fed tied now?

"If [supply chains] don’t unwind quickly or if the economy really is in a higher-pressure equilibrium, then we will likely have to push long-term real rates to a contractionary stance to bring supply and demand into balance," Minneapolis Federal Reserve Bank President Neel Kashkari for Reuters

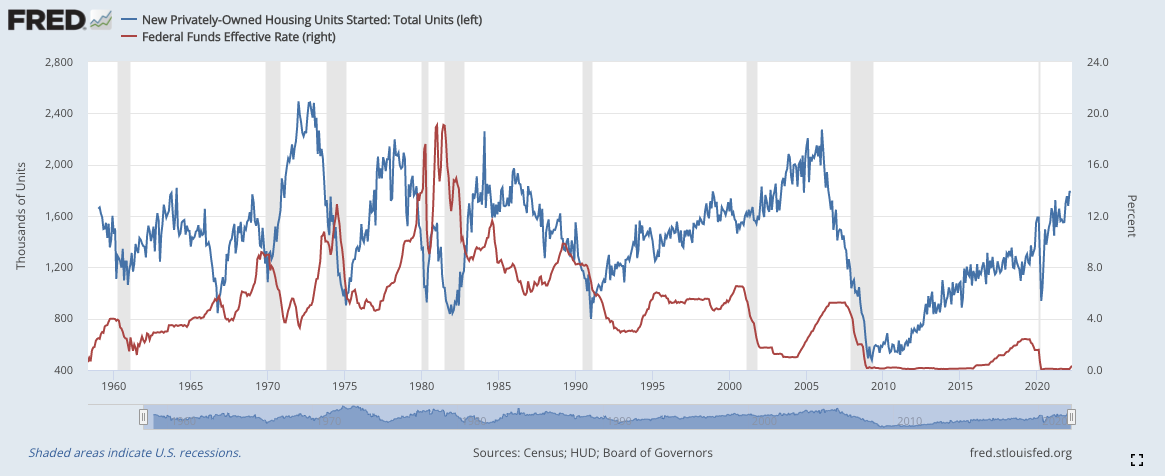

The Fed is now even suggesting that it might be forced to drive the economy into a recession by considerably increasing rates in order to bring down inflation. If this happens, expect home builders, banks, highly levered businesses and unprofitable tech companies to remain pressured for some time. Indeed, an unexpected and sharp rise in rates might depress the number of housing starts, drive down employment and reduce the home ownership rate in the U.S.

BENCHMARK'S TAKE

- The Fed won't change its stance until inflation cools down. This might lead it to repeat its 2020-mistakes where it sought to provide a strong answer in the face of challenges

- Unexpected rises in rates could depress certain sectors such as construction and banking while drying up the access to capital for growing yet unprofitable companies

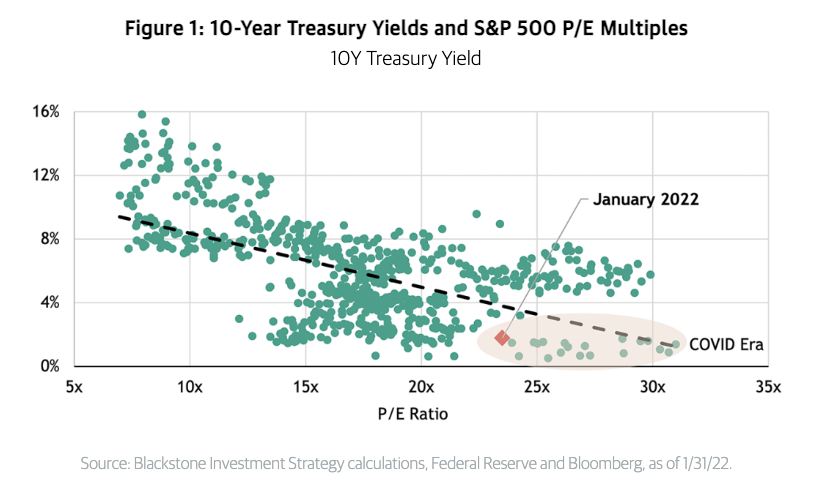

- At the same time, the ongoing valuation reset could continue to compress multiples for all companies, leaving no place to hide for investors

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits