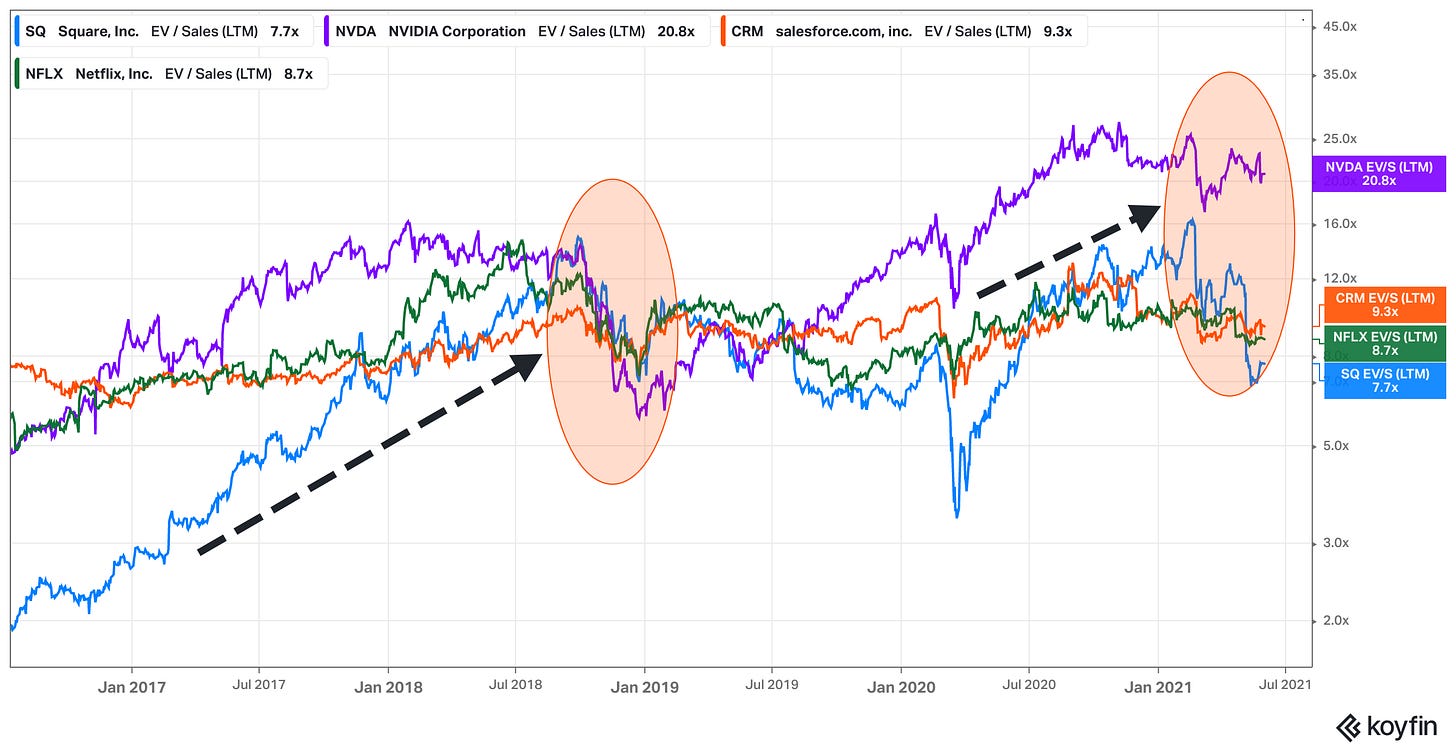

We are still cautious on U.S. tech as multiples remain in the upper range of their historical averages. All while inflationary pressures and yields keep long duration stocks in check. Combined with a post-pandemic slowdown in sales growth, it creates a scenario where most richly valued technology stocks could continue to trade sideways in the coming 3 months.

DEUTSCHE BANK SEES A WEAK ENVIRONMENT FOR GROWTH

Deutsche Bank agrees but doesn’t blame inflation expectations and rising yields for technology stocks’ underperformance. In a note to clients, the bank blamed slower forward earnings growth and outlined how, historically, rising yields haven’t stopped long duration stocks from climbing higher

“While rising interest rates have largely been blamed for the underperformance of tech stocks relative to cyclicals and the broader market, empirical evidence and fundamental considerations ‘strongly suggests that rates have had little if any role to play and the relationship might run in the opposite direction’ the note said”

“Instead of rising interest rates, the ongoing weakness in tech stocks has been driven by relative growth in earnings and extended valuations. While the pandemic benefitted relative earnings prospects for growth stocks, the ongoing post-pandemic cyclical recovery is now benefitting relative earnings for the rest of the S&P 500”

The note ends by outlining the possibility for further downside across technology stocks

“The strong underlying uptrend in growth stocks means that relative performance could re-align with relative earnings even with a sideways or slightly down relative price movement, and do not necessarily require a selloff” by Matthew Fox for Markets insider

LOOK IN THE PAST, FORECAST THE FUTURE

Despite a fair number of differences, the 2018 tech sell-off and the February 2021 growth-stocks drawdown demonstrate similarities as both:

- Were supported by fiscal changes: Tax Cuts And Jobs Act of 2017 and today’s massive fiscal stimulus

- Saw a significant rise in technology stocks’ prices over the year that led some investors to book their gains as valuations were stretched

- Yields were rising rapidly, boosted by a tightening job market

“The recent and rapid rise in long-dated yields, with the 10-year Treasury note TMUBMUSD10Y, 1.590% briefly topping 3.25% for the first time since April 2011 early Tuesday, has somewhat unsettled stock-market investors.” by William Watts for MarketWatch (article from 2018)

In both instances, stocks pulled back after a sustained rise that stretched multiples out of their historical averages.

“Most of these companies are about to report their latest quarterly earnings -- and they should be fairly strong. And most of these companies are somewhat immune from the growing trade war with China (with Apple being the notable exception).”

“But these titans of tech are vulnerable to the recent spike in long-term bond yields and signs from the Federal Reserve that it plans to keep hiking short-term rates throughout 2019. That could slow the economy and start to hurt profit growth of high-flying techs.” by Paul R. La Monica for CNN (article from 2018)

BUBBLES?

Some notable bubbles have formed in ultra-speculative assets as crypto-currencies and “meme-stocks” such as GameStop and AMC. For now, these bubbles do not form a systemic risk as they would only impact a small fraction of investors.

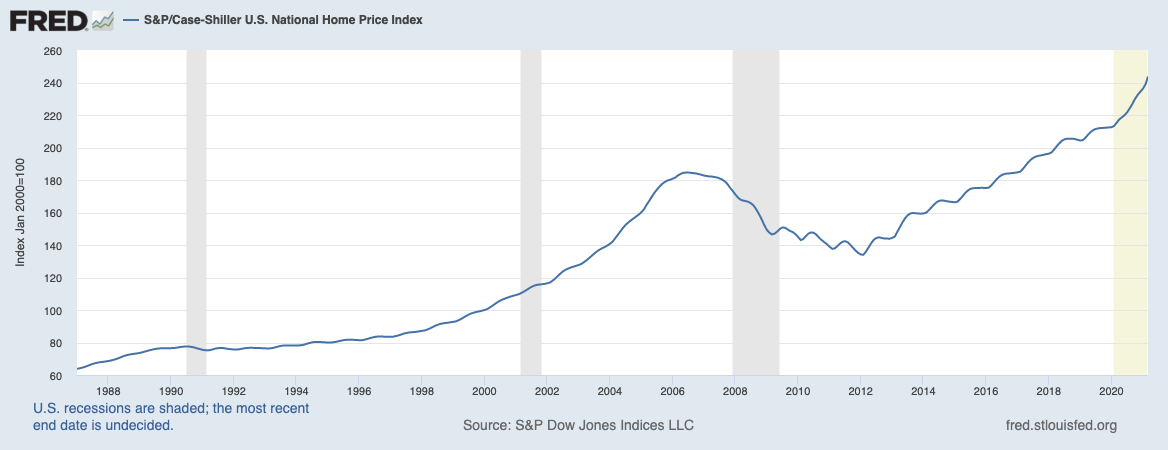

However, should asset prices (e.g. houses) further inflate, U.S. consumers might start feeling the wealth effect and this could flip the economy into overdrive. But is this sustainable?

“Is the red-hot housing market a bubble about to burst? […] Shiller calls the housing market a "bubble" — meaning prices are out of touch with economic reality — and predicts the market will collapse. The only question, he says, is when.” by Madeleine Brand for NPR (article from 2005)

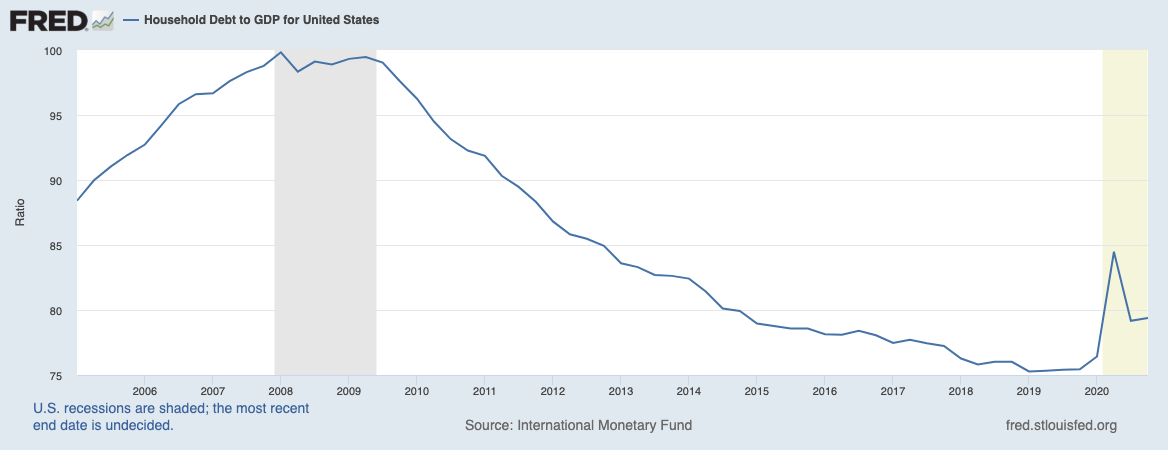

For now, the Fed is willing to bear the cost of higher inflation. However, it might prefer to avoid the errors it committed in 2007

“I don’t think the housing market needs the level of support that the Fed is currently providing” Dallas Federal Reserve Bank President Robert Kaplan by Reuters Staff

Of course, the 2008 comparison is not accurate as household debt was relatively higher back then and today’s environment presents a very different picture

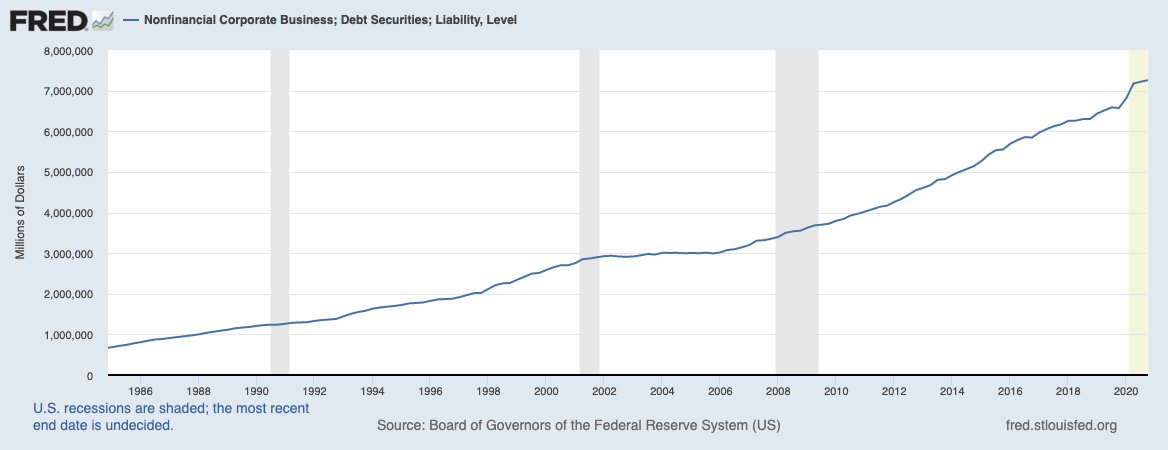

Still, should rates rise, heavily indebted corporate America might feel the pinch

“many of the nation’s most iconic companies aren’t earning enough to cover their interest expenses ”

“More than 200 corporations have joined the ranks of so-called zombie firms since the onset of the pandemic […] Even more stark, they’ve added almost $1 trillion of debt to their balance sheets in the span, bringing total obligations to $1.98 trillion.” by Lisa Lee and Tom Contiliano for Bloomberg

BENCHMARK’S TAKE

- Tech stocks are vulnerable to inflation and a rapid change in yields, strong earnings only isn’t going to save them in the short term

- We therefore believe investors should stay cautious as the coming months may reserve some inflationary surprises given the size of the governments stimulus and the willingness of the Fed to do whatever it takes to keep to party going

- The relatively small bubbles forming in parts of the markets (crypto-currencies, “meme-stocks”, some high-growth stocks) should not concern the Fed as their impact is limited

- However, we believe that investors should closely watch housing prices. If these sustain their ascent, the Fed might start to remove parts of its support

When taking a longer-term view, we do not believe inflation will sustain itself

- Supply chain hurdles will get cleared out, workers will gradually return to work (even if the economy doesn’t reclaim its pre-COVID employment rate in the face of an ageing population) and governments are providing the required assistance to stimulate the real economy

- But, we remain cautious on current valuations and are not in a hurry to buy over-valued growth stocks, we prefer to let some time pass for inflationary pressure to cool down

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Alfred Kenneally on Unsplash.