Union Pacific Railroad Company (UPRC) is a freight-hauling railroad company that runs 6,400 locomotives across 32,500 miles (52,300 km) of track in 23 U.S. states west of Chicago and New Orleans. UPRC is the principal operating company of the Union Pacific Corporation, both are headquartered in Omaha, Nebraska. After BNSF, a Berkshire Hathaway subsidiary, Union Pacific is the second largest railroad in the U.S. In the Western, Midwestern, and Southern U.S., Union Pacific and BNSF enjoy a duopoly on transcontinental freight train routes.

- Union Pacific was founded on July 1, 1862, when President Lincoln signed the Pacific Railway Act

- During the 1900s, Union Pacific merged with the Missouri Pacific Railroad, the Chicago and North Western Transportation Company, the Western Pacific Railroad, the Missouri–Kansas–Texas Railroad and the Chicago, Rock Island and Pacific Railroad

- In 1996, Union Pacific merged with Southern Pacific Transportation Company, itself a giant that was absorbed by the Denver and Rio Grande Western Railroad in 1988

A Network Connecting U.S. Supply Chains

The company operates 32,500 route miles in the U.S., connecting Pacific Coast and Gulf Coast ports with the Midwest and eastern U.S. and providing several corridors to key Mexican gateways.

- Union Pacific serves the Western two-thirds of the U.S.

- The company maintains coordinated schedules with other rail carriers to move freight to and from the Atlantic Coast, the Pacific Coast, the Southeast, the Southwest, Canada, and Mexico

- Export and import traffic moves through Gulf Coast and Pacific Coast getaways and across the Mexican and Canadian borders

A U.S. Railroad Freight Powerhorse

The Railroad, along with its subsidiaries and rail affiliates, is Unions Pacific's only reportable operating segment.

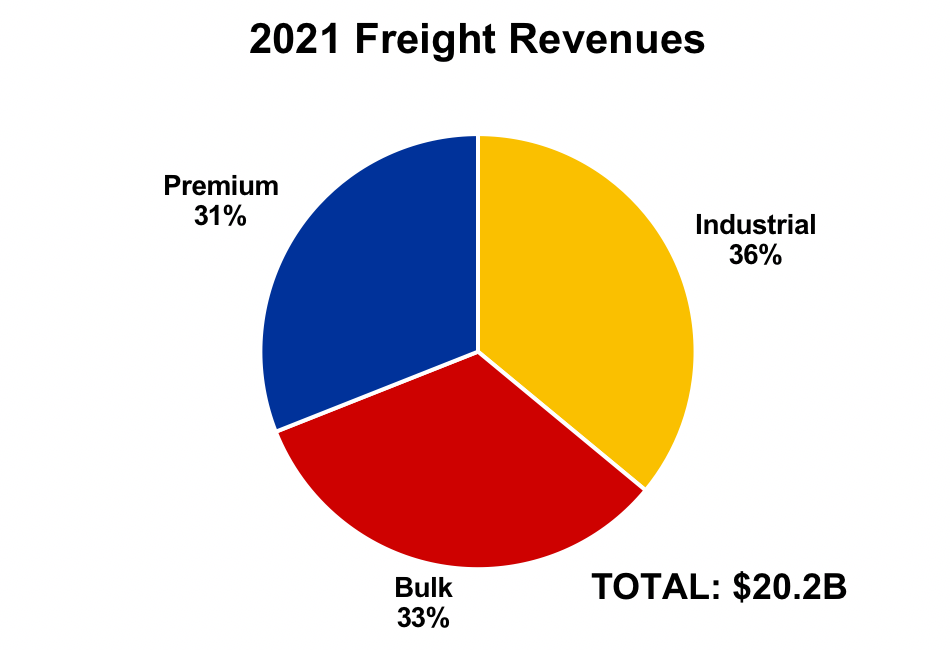

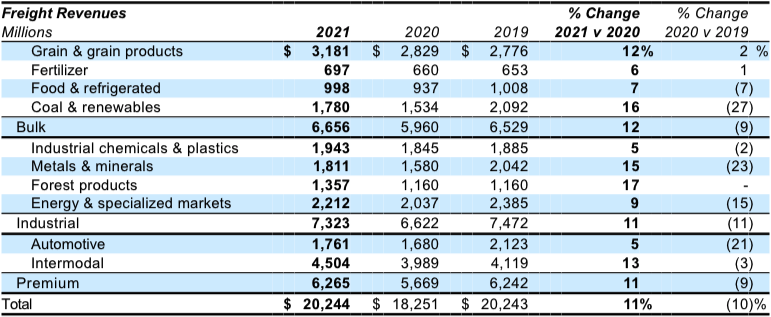

In 2021, Union Pacific generated freight revenues totaling $20.2 billion from the following three commodity groups: (i) bulk shipments, (ii) industrial shipments and (iii) premium shipments.

- (i) Bulk shipments: The company's Bulk shipments consist of grain and grain products, fertilizer, food and refrigerated, and coal and renewables. In 2021, it generated 33% of Union Pacific's freight revenues. The company has access to most major grain markets which connect the Midwest and Western U.S. producing areas to export terminals in the Pacific Northwest and Gulf Coast ports as well as Mexico. Moreover, Union Pacific also serves significant domestic markets, including grain processors, animal feeders, and ethanol producers in the Midwest and West. The railroad’s network supports the transportation of coal shipments to power companies and industrial facilities throughout the U.S. The coal traffic originating in the Powder River Basin (PRB) area of Wyoming is the largest portion of the Railroad’s coal business. Finally, renewable shipments consist primarily of biomass exports and wind turbine components

- (ii) Industrial shipments: Industrial shipments consist of several categories, including construction, industrial chemicals, plastics, forest products, specialized products (primarily waste, salt, and roofing), metals and ores, petroleum, liquid petroleum gases (LPG), soda ash, and sand. Industrial shipments accounted for 36% of Union Pacific's freight revenues in 2021

- (iii) Premium shipments: In 2021, premium shipments generated 31% of Union Pacific’s total freight revenues. The group includes finished automobiles, automotive parts, and merchandise in intermodal containers, both domestic and international. Union Pacific is the largest automotive carrier west of the Mississippi River and operates or accesses 38 vehicle distribution centers. The Railroad’s extensive franchise serves five vehicle assembly plants and connects to West Coast ports, all six major Mexico gateways, and the Port of Houston to accommodate both import and export shipments

THE MARKET

From 2021 to 2028, the North American Rail Transport Market is expected to grow at a CAGR of 4.3%, from $85 billion in 2020 to $130 billion in 2028.

Freight rail is a pillar of the U.S. economy. The $85 billion market is shared by seven major railroads companies and several smaller regional and local line railroads. The industry provides more than 170,000 jobs.

- Running on almost 140,000 route miles, the U.S. freight rail network is widely considered as one of the largest freight system in the world.

- The U.S. accounts for about a quarter of global rail freight activity

- Around 93% of kilometres travelled by train are for freight rather than passengers,around a third of this is for the transport of coal

Among the seven major freight railroads that connect North America. The west is dominated by Union Pacific and BNSF. The main east coast operators are CSX and Norfolk Southern, while Kansas City Southern, as well as Canadian Pacific and Canadian National, run routes north and south.

Freight rail competes directly with any kind of freight company transporting commodities throughout the U.S., from coal to automobiles to chemicals. However, trains are increasingly transporting consumer products, thanks to the expansion of e-commerce giants like Amazon.

One Of The Most Energy-Efficient Transport Mode

According to the Association of American Railroads, freight railroads account for roughly 40% of U.S. long-distance freight volume (measured by ton-miles) which is more than any other mode of transportation. However, they account for just 0.5% of total U.S. greenhouse gas emissions (GHG) according to EPA data, and just 1.9% of transportation-related GHG.

- Railroads are the most fuel-efficient way to move freight over land, moving one ton of freight nearly 500 miles per gallon of fuel, on average

- On average, railroads are three to four times more fuel-efficient than trucks as a single freight train can replace several hundred trucks

- Railroad GHG are directly related to fuel consumption meaning moving freight by rail instead of truck lowers greenhouse gas emissions by up to 75%, on average

"The rail sector can provide substantial benefits for the energy sector as well as for the environment. By diversifying energy sources and providing more efficient mobility, rail can lower transport energy use and reduce carbon dioxide and local pollutant emissions." Dr Fatih Birol, IEA Executive Director

Profiting From Supply Chain Crises

In 2021, a shortage of railroad workers led to rail terminal bottlenecks in the U.S., creating delays in the transfer of chemicals, fertilizers, and other goods causing supply chain disruptions threatening factory operations.

- However, major U.S. railroad corporations were able to hike prices for freight caught in supply chain bottlenecks while decreasing costs

- Companies also cut costs by using Precision Scheduled Railroading (PSR), which entails streamlining schedules and reducing the quantity of workers as well as locomotive and car fleets

EXPERIENCED MANAGEMENT

Union Pacific is led by Lance Fritz who has been with the company since 2000.

- Union Pacific's chairman, president and chief executive officer

- He became chairman of the board in October 2015 after becoming president and chief executive officer in February 2015

- He previously served as president and chief operating officer, a position he had held since February 2014, after serving as executive vice president-Operations and vice president-labor Relations, respectively

- He began his Union Pacific career in July 2000 as vice president and general manager-energy in the company’s Marketing and Sales department

- Before joining Union Pacific, Fritz worked for Fiskars Inc., Cooper Industries and General Electric

- He is a graduate of Bucknell University and earned a master’s degree in management from the Kellogg School of Management at Northwestern University

- Union Pacific's vice president-external relations since December 2018

- Bolin is responsible for communicating inside the Beltway about transportation and railroad issues, including economic and safety regulation, passenger rail and Amtrak, security, labor, state-specific and other transportation projects

- Bolin served as assistant vice president-external relations since 2008, he held various positions since joining Union Pacific in 1991

- He holds a bachelor’s degree from the University of Mississippi

- Union Pacific's executive vice president-operations since January 2021

- He is responsible for all aspects of Union Pacific’s operations, including continued implementation of the railroad’s operating plan, and its Engineering and Mechanical departments

- Previously, Gehringer served as vice president-mechanical and engineering

- He joined Union Pacific in 2006 as a management trainee following time at Northwest Airlines and Daimler Chrysler

- Gehringer is a graduate of St. Louis University with a degree in aerospace engineering, he received a Master of Business Administration from the University of Nebraska-Lincoln

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Union Pacific Railroad Company (UPRC) is a freight-hauling railroad that runs 6,400 locomotives across 32,500 miles (52,300 km) of track in 23 U.S. states

- Union Pacific and BNSF enjoy a duopoly on transcontinental freight train routes in the Western, Midwestern, and Southern U.S.

- In 2021, Union Pacific generated freight revenues totaling $20.2 billion from three commodity groups: (i) bulk shipments, (ii) industrial shipments and (iii) premium shipments

- Freight rail is a pillar of the U.S. economy, from 2021 to 2028, the North American Rail Transport Market is expected to grow at a CAGR of 4.3%, from $85 billion in 2020 $130 billion in 2028

- Railroads are the most fuel-efficient way to move freight over land and could benefit from the shift towards less carbon intensive freight transportation

- Major U.S. railroad corporations were able to hike prices for freight caught in supply chain bottlenecks while decreasing costs, enabling them to benefit from the supply chain crisis

- Union Pacific is led by Lance Fritz who has been with the company since 2000

FINANCIAL CHECK

Union Pacific achieved Q1 2022 net income of $1.6 billion or $2.57 diluted EPS, vs. Q1 2021 net income of $1.3 billion and $2.00 diluted EPS.

- Operating revenue of $5.9 billion was up 17% driven by higher fuel surcharge revenue, volume growth, core pricing gains, and a positive business mix

- Business volumes, as measured by total revenue carloads, were up 4%

- Union Pacific’s operating ratio improved 70 basis points to 59.4%

- Operating income was up 19% to $2.4 billion

- The company repurchased 11 million shares in first quarter 2022 at an aggregate cost of $2.8 billion

Union Pacific's 2021 freight revenues climbed by 11% year-over-year to $20.2 billion. However, 2021 volume levels were still 4% lower than the pre-COVID levels of 2019.

- Operating expenses increased $767 million in 2021 to $12.4 billion driven by higher fuel prices, volume-related costs, inflation, higher casualty costs, 2020 management actions, weather and wildfire-related expenses, incentive compensation, and higher state and local taxes

- Net income amounted to $6.5 billion and diluted EPS to $9.95, up from $7.88 in 2020

- $10.1 billion was returned to shareholders as dividends and share repurchases in 2021, vs. $6.3 billion in 2020 and $8.4 billion in 2019

THE BOTTOM LINE

The Good

- Union Pacific fared well through the pandemic and the resulting supply chain crisis as it managed to pass on higher costs to customers

- The shift towards less carbon intensive freight transportation provides Union Pacific a significant advantage over competing transportation modes

- The company returned a massive $10 billion to shareholders in 2021, this trend is set to be pursued in the future with the company already repurchasing nearly $3 billion of shares during Q1 2022

The Bad

- Railroads are a mature, cyclical business for which revenue growth closely tracks GDP growth, a U.S. economic slowdown could adversely impact Union Pacific' revenues

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Eddie Bugajewski on Unsplash