Semiconductors And Software Supplier

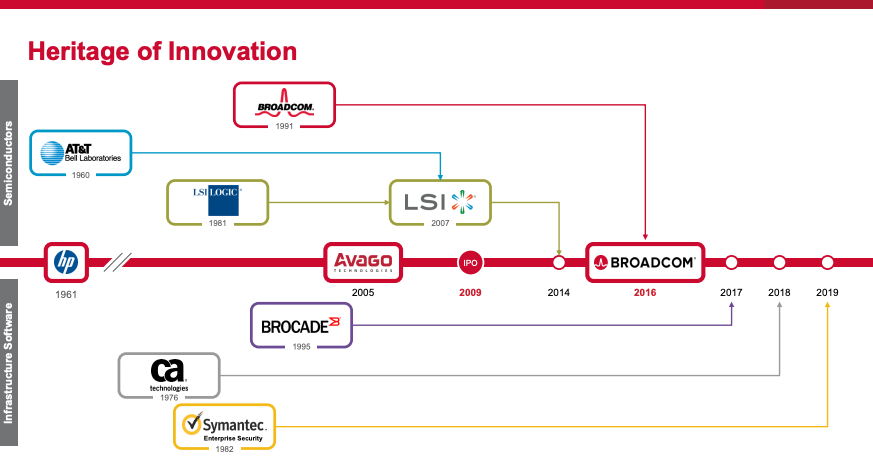

Broadcom is a global technology leader that designs, develops and supplies a broad range of semiconductor and infrastructure software solutions. Its 50-years history dates back to diverse origins from HewlettPackard Company, AT&T, LSI Corporation, Broadcom Corporation, Brocade Communications Systems LLC and Symantec Enterprise Security.

- Over the years, the company has assembled a large team of semiconductor and software design engineers around the world and it has design, product and software development engineering resources in the U.S., Asia, Europe and Israel

- The company serves the data center, networking, software, internet, wireless, storage, and industrial markets at a global level

The CEO and president of the business is Tan Hock Eng and its headquarters are located in San Jose, California.

Diversified Semiconductor Player

Its product portfolio ranges from discrete devices to complex sub-systems that include multiple device types and may also incorporate firmware for interfacing between analog and digital systems.

- In some cases, its products include mechanical hardware that interfaces with optoelectronic or capacitive sensors

- The company focusses on markets that require the high quality and the integrated performance characteristics of its products

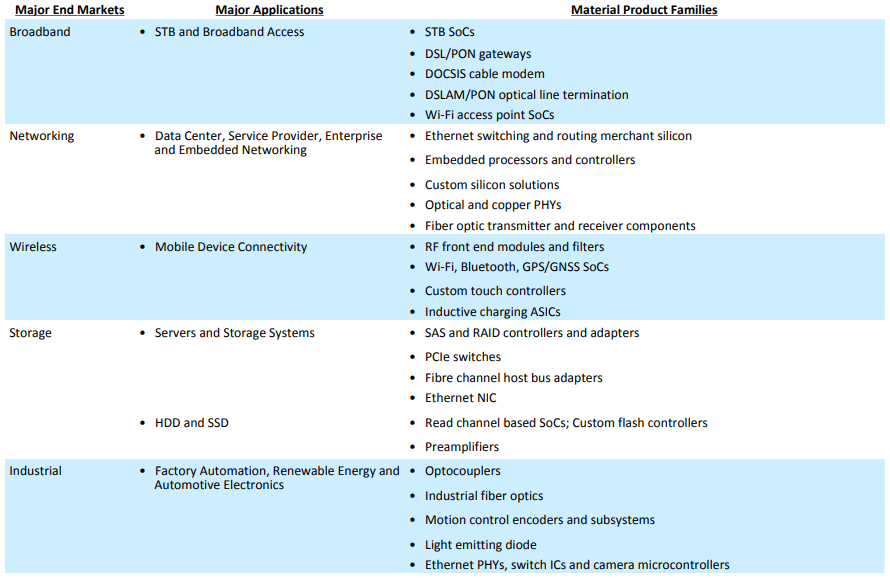

The table below presents Broadcom's material semiconductor product families and their major end markets and applications during fiscal year 2022.

Advanced Capabilities

Broadcom's digital and mixed signal products are based on silicon wafers with CMOS transistors offering fast switching speeds and low power consumption, which are both critical design factors for the markets it serves. Its devices are designed to perform various functions such as processing, amplifying and selectively filtering electronic signals, controlling electronic system functions and processing, transmitting and storing data

- It also offers analog products, which are based on III-V semiconductor materials that have higher electrical conductivity than silicon, and thus tend to have better performance characteristics in radio frequency (“RF”), and optoelectronic applications

- The company further provides semiconductor solutions for managing the movement of data in data center, service provider, enterprise and embedded networking applications

It thus delivers a broad variety of RF semiconductor devices, wireless connectivity solutions, custom touch controllers and inductive charging solutions for the wireless market. It also provides semiconductor solutions for enabling the set-top box (“STB”) and broadband access applications and for enabling secure movement of digital data to and from host machines, such as servers, personal computers and storage systems, to the underlying storage devices, such as hard disk drives (“HDD”) and solid-state drives (“SSD”).

Apple As A Large Buyer

Broadcom sells its products through its direct sales force and a select network of distributors and channel partners globally. Distributors and OEMs, or their contract manufacturers, typically account for the substantial majority of its semiconductor sales. A relatively small number of customers account for a significant portion of its net revenue. Sales to distributors accounted for 56% and 53% of its net revenue for fiscal years 2022 and 2021, respectively.

- According to the Broadcom, its aggregate sales to its top five end customers, through all channels, accounted for approximately 35% of its net revenue for each of the fiscal years 2022 and 2021

- It believes aggregate sales to Apple, through all channels, accounted for approximately 20% of its net revenue for each of fiscal years 2022 and 2021.

The company expects to continue to experience significant customer concentration in future periods.

The Market

Market growth is supported by the growing demand for integrated circuits in devices such as military weapons, gaming devices, smartphones and computers. This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices.

In 2019, the silicon wafer market was valued at $11.2 billion.

- It is projected to grow to $14.4 billion by 2026, representing a

CAGR of 4.2% during the forecast period (2021-2026) - This growth will be attributed to the increasing use of integrated circuits in devices such as military weapons, gaming devices, smartphones and computers

- It will also be attributed to the technological advances that are designed to improve wafer capabilities

In 2020, the global cyber security market was valued at $156.2 billion.

- It is projected that by 2026, it will be valued at $352.3 billion, representing a CAGR of 14.5% during the forecast period (2021-2026)

- The growth will be attributed to the increasing cases of cyber security incidents, the growing demand for strengthened cyber security solutions, along with the high reliance on traditional authentication

- It is projected that the aerospace and defence segment will experience significant growth, while Asia-Pacific will post the fastest growth during the forecast period

In 2020, the global Internet of Things (IoT) market was valued at $761.4 billion.

- It is estimated that by 2026, the industry will be valued at $1.4 trillion, representing a CAGR of 10.5% during the forecast period (2021-2026)

- This growth will be fueled by the collaboration currently being witnessed by vendors in the market which are offering emerging tech-enabled solutions in various areas, including healthcare

- This growth will also be facilitated by the overall development of wireless networking technologies, the emergence of advanced data analytics, along with the connectedness that comes with the proliferation of smart devices

- North America remains the best performing IoT market owing to the deployment of connected cars, home automation, smart energy projects and smart manufacturing

Experienced Management

Broadcom is led by Hock Tan, who served as chairman of the board of Integrated Device Technology and was the President and Chief Executive Officer of Integrated Circuit Systems from June 1999 to September 2005.

- Hock Tan is Broadcom President, Chief Executive Officer and Director. He has held this position since March 2006

- From September 2005 to January 2008, he served as chairman of the board of Integrated Device Technology. Prior to becoming chairman of IDT, Mr. Tan was the President and Chief Executive Officer of Integrated Circuit Systems from June 1999 to September 2005. Prior to ICS, Mr. Tan was Vice President of Finance with Commodore International from 1992 to 1994, and previously held senior management positions with PepsiCo and General Motors. Mr. Tan served as managing director of Pacven Investment, a venture capital fund in Singapore from 1988 to 1992, and served as managing director for Hume Industries in Malaysia from 1983 to 1988

- Charlie Kawwas is President of the Semiconductor Solutions Group at Broadcom, overseeing the company’s global operations, as well as sales for the Semiconductor and Brocade Storage Networking businesses and corporate marketing for all of Broadcom

- Prior to this role, Dr. Kawwas served as Chief Operating Officer from December 2020, and Senior Vice President and Chief Sales Officer at Broadcom from May 2014. Dr. Kawwas joined the company through the LSI acquisition where he was head of worldwide sales. Previous positions at LSI include Vice President of Sales and Marketing for the networking division and Vice President of Marketing for the networking and storage products group. Before joining LSI, Dr. Kawwas was the leader of Product Line Management for the Optical Ethernet and Multi-service Edge portfolio at Nortel

- Dr. Kawwas received a B.Eng. in Computer Engineering, an M.S. in Electrical Engineering and Computer Engineering, and a Ph.D. in Electrical and Computer Engineering from Concordia University, Montreal, Canada. Dr. Kawwas was awarded Alumnus of the Year for 2020 by Concordia University

- Kirsten Spears is Chief Financial Officer and Chief Accounting Officer at Broadcom, overseeing all financial functions

- Ms. Spears previously served as Vice President and Corporate Controller at Broadcom from May 2014 to December 2020 and prior to that was Vice President and Corporate Controller at LSI. She joined LSI in September of 1997 and held a number of management positions in accounting and reporting before becoming the Corporate Controller in 2007. Before LSI, Ms. Spears worked for PriceWaterhouseCoopers in audit; for Raychem, managing a variety of accounting functions; and for Bank of America, managing branch operations

- Ms. Spears holds an M.B.A. from Santa Clara University

Solid Financial Results

Broadcom's fiscal year 2022 revenue grew 21% year-over-year to a record $33.2 billion, as a result of strong demand from hyperscale, service providers, and enterprise. This growth was driven by Broadcom's strong partnerships with customers and accelerated adoption of its next generation technologies.

- Cash from operations of $4,583 million for the fourth quarter, less capital expenditures of $122 million, resulted in $4,461 million of free cash flow, or 50% of revenue

- Quarterly common stock dividend increased by 12% to $4.60 from the prior quarter

- Revenue of $8,930 million for the fourth quarter, up 21% from the prior year

- GAAP net income of $3,359 million for the fourth quarter and adjusted EBITDA of $5,722 million for the fourth quarter

- GAAP diluted EPS of $7.83 for the fourth quarter and non-GAAP diluted EPS of $10.45 for the fourth quarter

- First quarter revenue guidance of approximately $8.9 billion, an increase of 16% from the prior year

"In fiscal 2022 we achieved record adjusted EBITDA margin of 63%, generating $16.3 billion in free cash flow or 49% of revenue, demonstrating our stable and focused business model, [...] Consistent with our commitment to return cash to shareholders, we will resume our authorized share repurchase programs for the remaining $13 billion, and we are increasing our quarterly common stock dividend by 12 percent to $4.60 per share for fiscal year 2023. The target fiscal 2023 annual common stock dividend of $18.40 per share is a record, and the twelfth consecutive increase in annual dividends since we initiated dividends in fiscal 2011." Kirsten Spears, CFO of Broadcom Inc.

THE BOTTOM LINE

The Good

- Broadcom is in a solid financial shape and manages to grow sales and dividends quarter over quarter

- Its products and technology are vital to its customers and demand is on an upward trajectory

The Bad

- The company may be hurt by the slowdown in demand for semiconductors in the short term

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Vishnu Mohanan on Unsplash.