Affirm, located in San Francisco, is a publicly traded financial technology firm. The company, which was founded in 2012, is a financial lender that provides consumers with instalment loans to finance purchases at the point of sale. The company was the first concept coming out of the startup studio HVF.

- The company went public in 2021 and raised around $ 1.2B. By then, the company was generating $ 174m in sales, lost $ 15.3m and was $ 1.1B in debt

- It served over 6.2m customers and 6,500 merchants, for a total Gross Merchandise Value (GMV) of $ 10.7B

- Shopify, BigCommerce, and Zen-Cart are among the e-commerce platforms with which Affirm has worked

- Until January 2023, Affirm is Amazon's exclusive Buy-Now-Pay-Later (BNPL) partner in the United States

BUY NOW PAY LATER

Affirm enables shoppers to pay for items in fixed amounts without delayed interest, hidden fees, or penalties. Customers have the option of paying over time rather than everything at once for a product. This is meant to somewhat enhance the spending power of customers by giving them more flexibility.

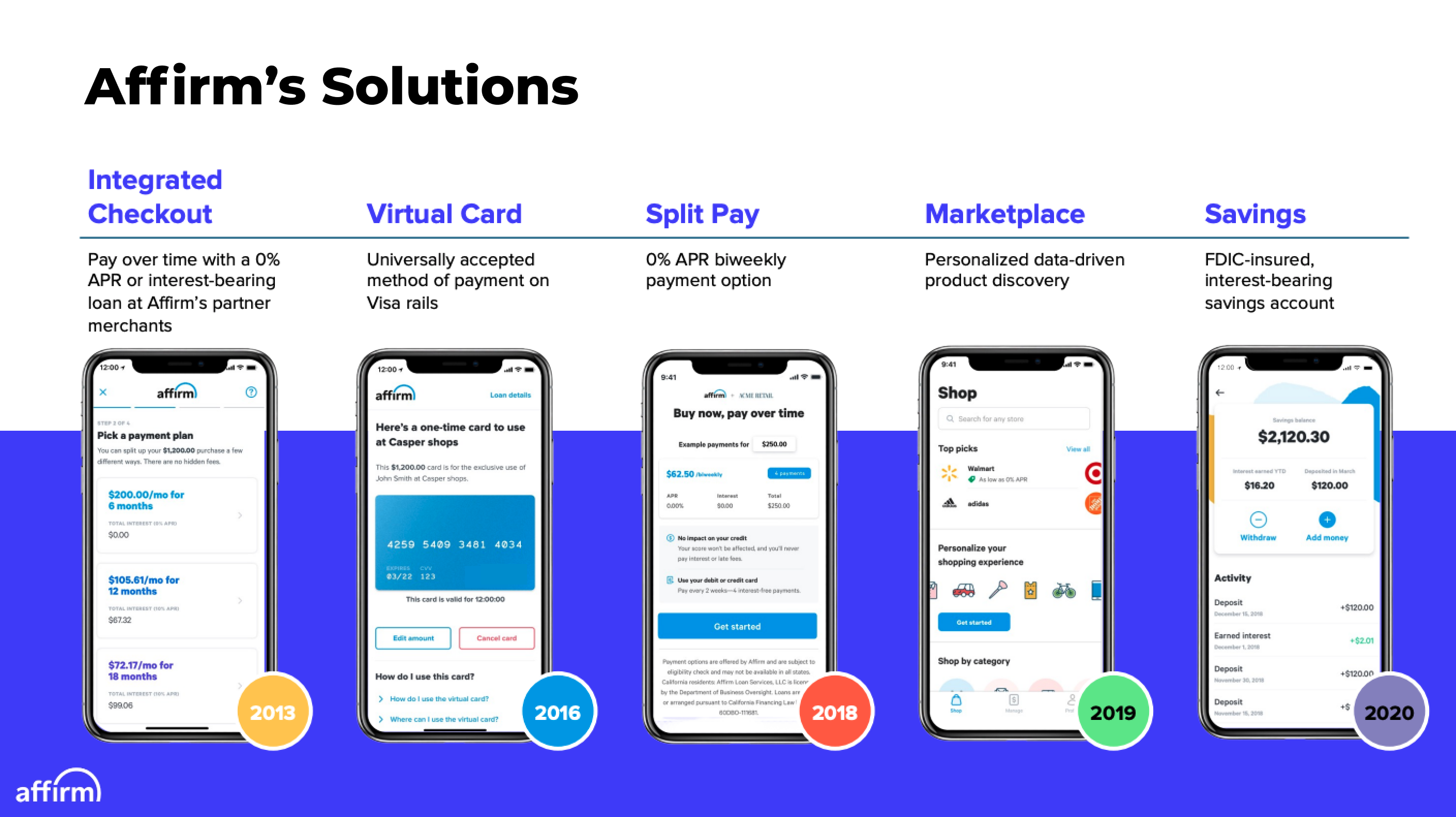

The company offers 3 solutions for now:

- Solutions for consumer point-of-sale: Consumers may pay for items over time in defined amounts without delayed interest, hidden fees, or penalties using Affirm's point-of-sale solutions. Consumers pay no interest and incur no additional charges when they use Affirm's 0% APR payment alternatives. The company charges simple interest on the interest-bearing loans it arranges, which means that customers pay fixed amounts of interest that they agree to up front, and the interest never compounds

- Merchant Commerce Solutions: Affirm's technologies help merchants increase demand generation, advertise and sell their items more effectively, improve client acquisition methods, and drive incremental sales. This is done as Affirm's solutions enable retailers to smoothen affordability issues

- Consumer Offerings: Consumers can use the Affirm app to manage payments, open a high-yield savings account, and access a personalized marketplace. This marketplace serves as a discovery platform that allows consumers to find products and make purchases from partner merchants. In addition, its app allows merchants to provide tailored offers based on consumers’ spending patterns, shopping habits, and purchase intent

Affirm is also beginning to roll out Affirm Debit+, the first U.S. debit card to have direct access to pay-over-time functionality. Affirm Debit+ will allow consumers to pay upfront, from their bank account, or pay later, by using a post-purchase feature to instantly convert any eligible transaction into one that is pay-over-time.

THE "DATA FLYWHEEL"

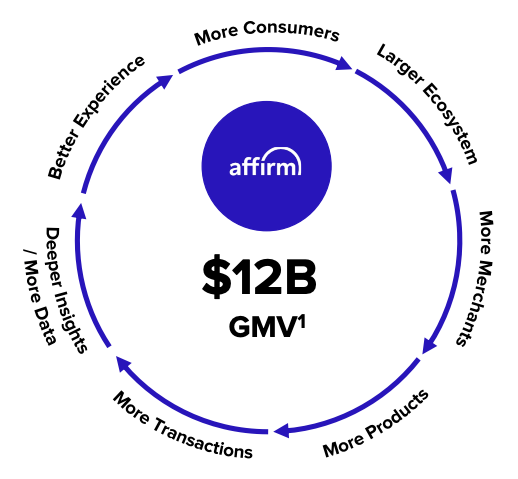

Affirm's vertically integrated technology powers a large data landscape across products, which drives increased efficiency that unlocks greater scale. Increasing scale powers a flywheel that further drives incremental data capture and improves the efficiency of each transaction, and that efficiency allows it to more finely price transactions, measure risk and deliver value to merchants and shoppers.

- Fraud detection capabilities: Affirm's fraud models utilizes SKU-level data, where the item is being shipped, and approximately 40-80 other data points in order to make a near-instantaneous decision on whether to block a transaction. There are also secondary rules that, when triggered, are designed to ensure a transaction is sent to fraud investigators

- Credit check capabilities: It models out the repayment probability on a month-to-month basis and combine these probabilities with the term length, purchase size, merchant, and item being purchased, in order to price and score risk. In the majority of cases, Affirm can complete these checks and calculations in a matter of seconds, automating the underwriting process pursuant to the originating bank partners’ underwriting policies. Affirm uses application and transaction data from more than 30.1 million loans and over seven years of repayments to train its models

Yet, given the size of its credit losses over time, a key driver of Affirm's success may not be its so-called "data flywheel". Its real advantage might rather be its vast economic resources and partnerships with key retailers such as Amazon to gain a strong foot in this competitive market.

GROWTH PROSPECTS

Data can help Affirm improve its products. Yet, many of its competitors such as legacy payment methods, competing BNPL players and large e-commerce players also have large swaths of data at hand. In order to compete and protect its position, the company is slowly turning itself into a do-it-all financial technology firm, with products ranging from checkout solutions to debit cards.

- Adaptive checkout solutions: Dynamically provides optimized biweekly and monthly payment options in a single integrated checkout solution

- Cash back and rewards: Offers loyalty rewards for engagement with Affirm

- The Affirm SuperApp: Combines commerce, payments and financial services into one app

- Crypto savings: Allows customers to buy/sell crypto directly from their savings account

- Affirm debit card: Debit card that supports debit transactions and also enables consumers to split eligible purchases into pay over time

REQUIRED DIVERSIFICATION

These solutions are meant to increase the lifetime value of its customers and spread out its acquisition cost over several products. Something the company might be willing to do given the ballooning marketing costs it incurs.

"The company’s operating costs more than doubled to $557mn in the quarter, driven by big increases in sales, marketing and general and administrative expenses as it doubled its headcount and spent more on advertising."

"But mounting competition from other fintechs, as well as incumbent finance companies getting into the market, has put pressure on such companies to seek out other streams of revenue."

"Diversifying revenue is of particular importance to Affirm, which once received a third of its revenue from a single merchant that is in turmoil over weakening sales — home exercise company Peloton. This year, Peloton is likely to account for less than 10 per cent of revenue, said James Faucette, analyst at Morgan Stanley." by Imani Moise for The Financial Times

THE MARKET

The popularity of BNPL purchases has increased dramatically in the United States during the last 2 years. The global pandemic, along with the growing desire to stretch the cost of purchases over time, has led to widespread acceptance of BNPL solutions in the country, such as those offered by Klarna, Afterpay, Affirm, and PayPal. Furthermore, the surge in e-commerce purchases during the global pandemic has aided the expansion.

According to McKinsey & Company, BNPL is set to grow by 18 to 20% a year over the 2020 - 2023 period

- The outstanding balances for unsecured lending products is set to grow from $ 48B in 2016 to $ 182B in 2023

"About 60 percent of consumers say they are likely to use POS financing over the next six to 12 months." Puneet Dikshit et al. for McKinsey & Company

According to Worldpay’s 2020 Global Payments report, “buy now pay later” is one of then fastest growing e-commerce payment method globally.

- In North America, “buy now pay later” market share is expected to triple to 3% of the e-commerce payments market by 2023

- In other regions, such as EMEA, “buy now pay later” already accounts for almost 6% of the e-commerce payment market, and is expected to grow to almost 10% by 2023

According to Research And Markets, BNPL payment in the United States is expected to grow by 66.5% on annual basis to reach $ 82B in 2022.

- BNPL payment adoption is expected to grow steadily over the forecast period, recording a CAGR of 32.5% during 2022-2028. The BNPL Gross Merchandise Value in the country will increase from $ 49B in 2021 to reach $ 443B by 2028

"The buy-now-pay-later market has experienced rapid growth in recent years, fueled by the pandemic that has helped drive more online shopping." By Andrew Ackerman and AnnaMaria Andriotis for the Wall Street Journal

RISKY LOANS & REGULATION

But are only consumers who can't afford to settle the full bill at once using BNPL solutions? A research from McKinsey & Company found out that consumers with poor credit aren't the only ones that use point-of-sale financing. The credit mix is being altered by more premium merchants starting to offer financing at checkout, which is driving adoption among higher-credit clients. Consumers with credit ratings of 700 or better account for about 65% of total receivables originated by point-of-sale lenders.

- Affirm, for example, was originating upwards of $1 billion in loans at Peloton, an exercise equipment startup, with an average credit score of around 740

- Consumers with lower credit scores drive use of the lower-ticket "Pay in 4" model (Klarna, Afterpay), which allows consumers to split payments into four interest-free instalments

- However, even here, the low scores are due to smaller credit files, not poor credit usage

Still, following the opening of an inquiry into the sector by the US consumer authority back in December 2021, shares of numerous BNPL companies plummeted.

- The Consumer Financial Protection Bureau announced that it was requesting information on the risks and advantages of Affirm, Afterpay, Klarna, PayPal, and Zip's products

- The CFPB expressed worry about consumers' potential to swiftly amass debt through BNPL plans, as well as a lack of adequate regulatory disclosures and data gathering

EXPERIENCED MANAGEMENT

Affirm is led by Max Levchin, a serial entrepreneur who also co-founded PayPal, Glow and Slide. Levchin was also on the board of Yelp. Keith Rabois, the founder of Opendoor, is on the board of the company.

- Max Levchin is the founder of Affirm and has served as the Chairman and Chief Executive Officer since its founding in 2012

- Affirm was spun out of HVF, an exploration company Max Levchin founded in 2011 to create and fund companies that leveraged large data sets in new ways. At HVF, he also founded Glow, a women’s health company, where he remains on the board of directors. Prior to HVF, Levchin founded and was Chief Executive Officer of Slide, a personal media-sharing service. Slide was acquired by Google in 2010. Max Levchin also helped create Yelp Inc., a consumer internet company, where he served as chairman of its board of directors from its founding in 2005 until July 2015. Prior to this, Levchin co-founded PayPal, where he served as Chief Technology Officer from its founding until its sale to eBay in 2003

- Holds a B.S. in Computer Science from University of Illinois at Urbana-Champaign

- Keith Rabois has served as a member of Affirm's Board since 2013

- Has been a General Partner at Founders Fund since 2019. Prior to joining Founders Fund, he served as a Managing Director at Khosla Ventures from 2013 to 2019. Also served as the Chief Operating Officer of Square, an Executive Vice President of Strategy & Business Development at Slide, and as Vice President of Business & Corporate Development at LinkedIn. Began his career in the industry as a senior executive at PayPal and has also practiced as an attorney at Sullivan & Cromwell

- Earned his B.A. in Political Science from Stanford University and his J.D. from Harvard University

- Libor Michalek has served as a member of Affirm's Board since May 2021. Michalek has served as President, Technology, Risk and Operations since May 2021

- Previously served as Affirm's President, Technology from 2018 to May 2021. Michalek served as Chief Technology Officer from 2015 to 2018. Prior to joining Affirm, he served as an Engineering Director at YouTube and Google. Prior to that, Michalek served as the Chief Technology Officer of Slide, a personal media-sharing service, which was acquired by Google in 2010. He has also served in management positions at Topspin, Egroups, Talarian, Thinking Machines Corporation, and the National Center for Supercomputing Applications

- Earned his B.S. in Computer Science from University of Illinois at Urbana-Champaign

TAKE A BREATH

So… This is a lot of information. Let’s summarise:

- Affirm, located in San Francisco, is a publicly traded financial technology startup. The company, which was founded in 2012, is a financial lender that provides consumers with instalment loans that they can use to finance purchases at the point of sale

- Affirm enables shoppers to pay for items in fixed amounts without delayed interest, hidden fees, or penalties. Customers have the option of paying over time rather than everything at once for a product. This is meant to somewhat enhance the spending power of customers by giving them more flexibility

- Affirm's vertically integrated technology powers a large data landscape across products, which drives increased efficiency that unlocks greater scale. Increasing scale powers a flywheel that further drives incremental data capture and improves the efficiency of each transaction

- Yet, given the size of its losses over time, a key driver of Affirm's success may not be its so-called "data flywheel". Its real advantage might rather be its vast economic resources and partnerships with key retailers such as Amazon to gain a strong foot in this competitive market

- In order to compete and protect its position, the company is slowly turning itself into a do-it-all financial technology firm, with products ranging from checkout solutions to debit cards

- These solutions are meant to increase the life time value of its customers and spread out its acquisition cost over several products. Something the company might be willing to do given the ballooning marketing costs it incurs

- The popularity of BNPL purchases has increased dramatically in the United States during the last 2 years. The global pandemic, along with the growing desire to stretch the cost of purchases over time, has led to widespread acceptance of BNPL solutions in the country

- Consumers with poor credit aren't the only ones that use point-of-sale financing. The credit mix is being altered by more premium merchants starting to offer financing at checkout, which is driving adoption among higher-credit clients

FINANCIAL CHECK

Gross merchandise volume for the second quarter of fiscal 2022 was $ 4.5B, an increase of 115%. Excluding the impact from the completion of the initial rollout of Affirm's interest-bearing solution with Amazon in November, GMV doubled.

- Total revenue was $ 361.0m, a 77% increase, driven by increases in network revenue resulting from GMV growth, higher interest income related to growth in loans held for investment, gains on sales of loans due to higher forward flow volume, and greater servicing income as the platform portfolio scaled

- Total revenue less transaction costs increased 93% to $ 183.6m, primarily as a result of the strong revenue growth, as well as slower growth in transaction costs as the Company achieved scale efficiencies. In the period, provision for credit losses increased by $ 40.1m from the quarter ended December 31, 2020

- Active merchants increased from 8,000 to 168,000, driven primarily by the adoption of Shop Pay Instalments by merchants on Shopify's platform

- Active consumers grew 150% to 11.2m and increased by 2.5m, or 29%, compared to the period ended September 30, 2021

- Transactions per active consumer increased 15% to 2.5 as of December 31, 2021

- Net loss for the second quarter of fiscal 2022 was $ 159.7m compared to $ 26.6m in the second quarter of fiscal 2021

- Affirm's operating costs more than doubled to $ 557m in the quarter, driven by a considerable increases in sales, marketing and general and administrative expenses as it doubled its headcount and spent more on advertising

THE BOTTOM LINE

The Good

- Despite large losses, the company manages to grow in a very competitive market while introducing new business solutions that diversify its product mix

- The company is also successfully reducing its dependency on a selection of retailers it worked with

- If successful, Buy Now Pay Later companies could pose a significant threat to relatively more conventional players such as Visa and other credit solutions

The Bad

- Many BNPL companies have seen their valuation inflate in the last years as e-commerce took a central spot in consumers' lives

- BNPL companies operate in a vague regulatory landscape and haven't managed to book a profit yet

- Many continue to question the potential profitability of these businesses as Affirm's operating expenses ex-SG&A stood at 76% of sales while SG&A expenses on their own stood at 78% of sales

THE STAKE

We do not have a stake in Affirm yet. Affirm is a growing but unprofitable financial technology company active in the buy-now-pay-later market. It aims to sustain its growth trajectory by entering adjacent markets while closing key partnerships with established e-commerce and financial services companies.

- We will start a stake if it manages sustain its growth while significantly reduce its operating expenses and improve its credit losses

- We will stop considering if it fails to reduce its debt and doesn't manage to demonstrate a clear path to profitability

Disclaimer

Please note that this article does not constitute investment advice in any form. This article is not a research report and is not intended to serve as the basis for any investment decision. All investments involve risk and the past performance of a security or financial product does not guarantee future returns. Investors have to conduct their own research before conducting any transaction. There is always the risk of losing parts or all of your money when you invest in securities or other financial products.

Credits

Photo by Affirm.