Meituan Hit With $ 534m Antitrust Fine

China's State Administration for Market Regulation (SAMR) announced on Friday that Meituan had abused its monopoly in the country's online food delivery market.

Go Deeper (2 min read)Twitter Sells MoPub To AppLovin For $ 1.05B

MoPub was purchased by Twitter for $350 million in 2013 and will be sold for $1.05 billion in cash. According to Twitter, MoPub helped the business generate $188 million in revenue last year. Twitter had previously stated that it wanted to double its yearly revenue by 2023.

Go Deeper (2 min read)Inflation Concerns Pressure Stocks

Soaring gas prices, staff shortages, a lack of ships are putting the view that inflation will be transitory to the test. While central bankers are confident that inflation will fall, they are beginning to acknowledge that it may remain higher for longer.

Go Deeper (2 min read)Meesho's valuation has more than doubled in less than six months to $ 4.9 billion, as a rising number of high-profile investors back the Indian social commerce business, which is growing rapidly despite the pandemic.

Go Deeper (2 min read)Hawkish Inflation Chorus

After last week's hawkish central bank chorus, ten-year Treasury rates are already up 8 basis points this week, leading a worldwide surge up in government borrowing costs.

Go Deeper (2 min read)

Yandex Takes Over Uber's Stake

Yandex took over Uber's stake in its self-driving group and its interests in Yandex.Eats, Yandex.Lavka and Yandex.Delivery. It spent $ 1B on it and gave the Russian company 100% ownership over these four business segments.

Go Deeper (2 min read)

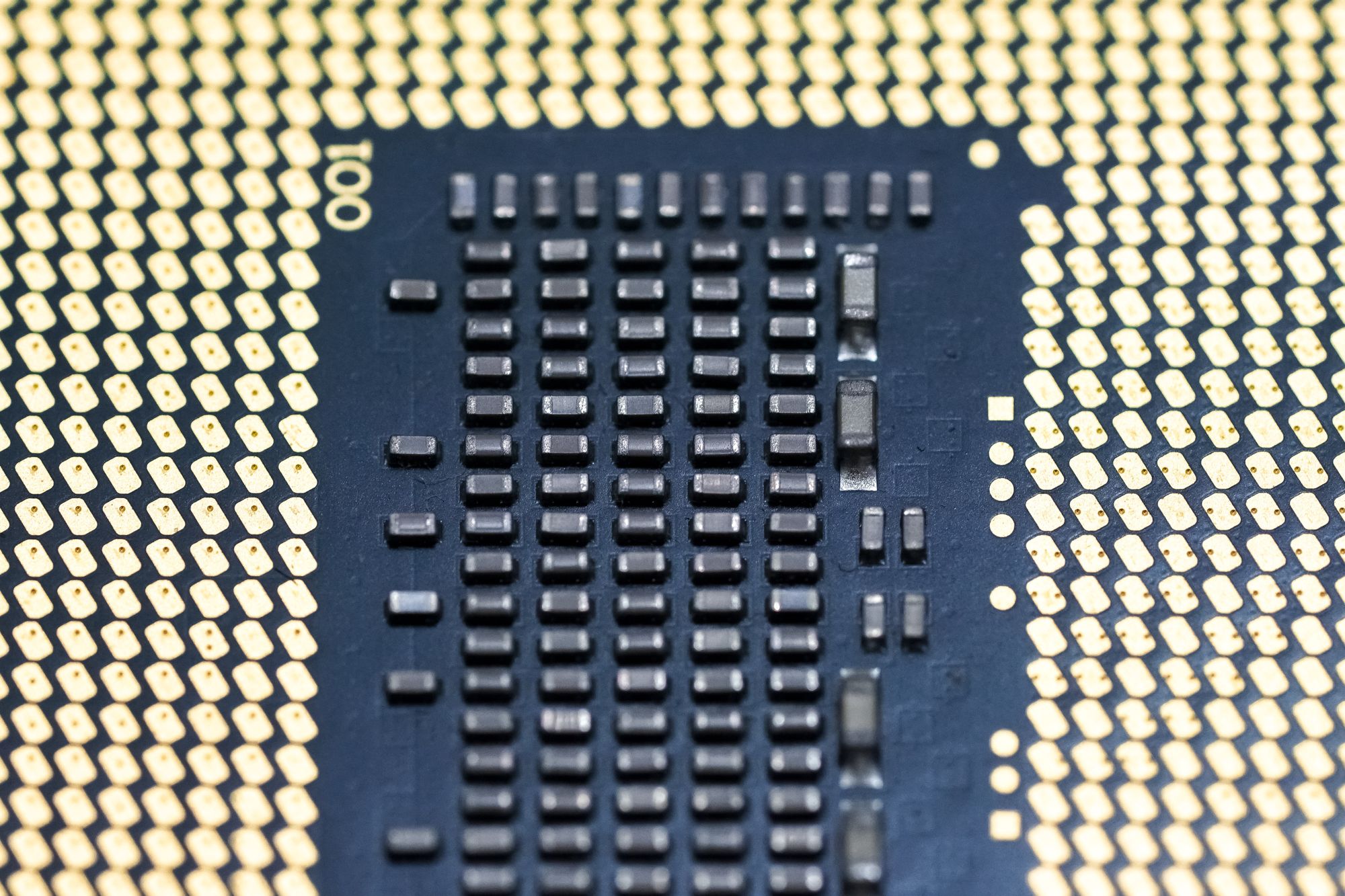

Synopsys, Silicon Champion

Founded back in 1986, Synopsis has grown to become a leader in innovation and technology. It is at the forefront of powering digital innovation by developing advanced silicon chips paired with software.

Go Deeper (8 min read)

Fed Is Still Cautious

Powell said Friday that the U.S. economic recovery appears to be making progress, but warned that the Fed needs to be careful not to tighten its policy before enough Americans are able to jump back in the labour market.

Go Deeper (2 min read)

Peloton's Growth Is Slowing, Cuts Prices

The fitness bike maker is expected to cut the price of its flagship bike as people head back to their local gyms and do less exercise at home. The company is also starting to shift its business mix back toward treadmill sales, which are less profitable than its cycles.

Go Deeper (2 min read)

Warby Parker's Direct Listing

Its net revenue grew to $ 394m in the most recent fiscal year yet its net loss widened to $ 56m. For comparison, its sales stood at $ 273m in 2018 and $ 273m in 2019 while its net loss reached $ 22.9m in 2018 and it broke even in 2019.

Go Deeper (2 min read)

A previous draft of the law said that tech companies must ask for the user's consent to collect its data and users can withdraw at any time. On top of this, companies can't refuse to serve users that do not opt in unless the data is necessary for the provision of the product or the service.

Go Deeper (2 min read)